Union Bank of India Share Price Target 2025, 2030, 2040

Investing in public sector banks has always been a matter of curiosity for Indian investors. Among them, Union Bank of India holds a special position due to its strong legacy, vast branch network, and government backing. With India’s economy growing rapidly and the banking sector witnessing digital transformation, the big question is: What is the Union Bank of India share price target for the coming years?

In this detailed article, we will explore:

- Union Bank of India’s fundamentals and history

- Financial performance and quarterly results

- Growth drivers and challenges

- Expert analysis of Union Bank of India share price target (short term & long term)

- Forecast for 2025, 2030, and even 2040

- FAQs for retail investors

So, if you’re planning to invest in PSU banks or already holding Union Bank shares, this guide will give you clarity for the long run.

📌 About Union Bank of India

Union Bank of India (UBI) is one of the largest public sector banks in India, established in 1919. It was nationalized in 1969, and since then, it has been a key pillar of the Indian banking industry.

- Headquarters: Mumbai, Maharashtra

- Ownership: 74.76% held by Government of India (as of June 2025)

- Branches: 8,500+ across India

- ATMs: 11,000+

- Digital Users: Over 2.5 crore active customers

Union Bank has also merged with Andhra Bank and Corporation Bank in 2020, making it one of the top PSU banks in terms of assets and customer base.

📊 Union Bank of India Financial Performance (2024–2025)

The performance of any bank stock is directly linked to its financial health. Let’s look at UBI’s recent quarterly results:

| Quarter (FY 2025) | Total Income (₹ Cr) | Net Profit (₹ Cr) | EPS (₹) |

|---|---|---|---|

| Q1 – Jun 2025 | 31,78,134 | 4,11,553 | 5.39 |

| Q4 – Mar 2025 | 33,25,431 | 4,98,492 | 6.53 |

| Q3 – Dec 2024 | 31,37,450 | 4,60,363 | 6.03 |

| Q2 – Sep 2024 | 32,03,646 | 4,71,974 | 6.18 |

👉 Clearly, Union Bank has shown consistent growth in net profit, with improving EPS (Earnings per Share).

- NPA Reduction: Gross NPA ratio has steadily declined, improving investor confidence.

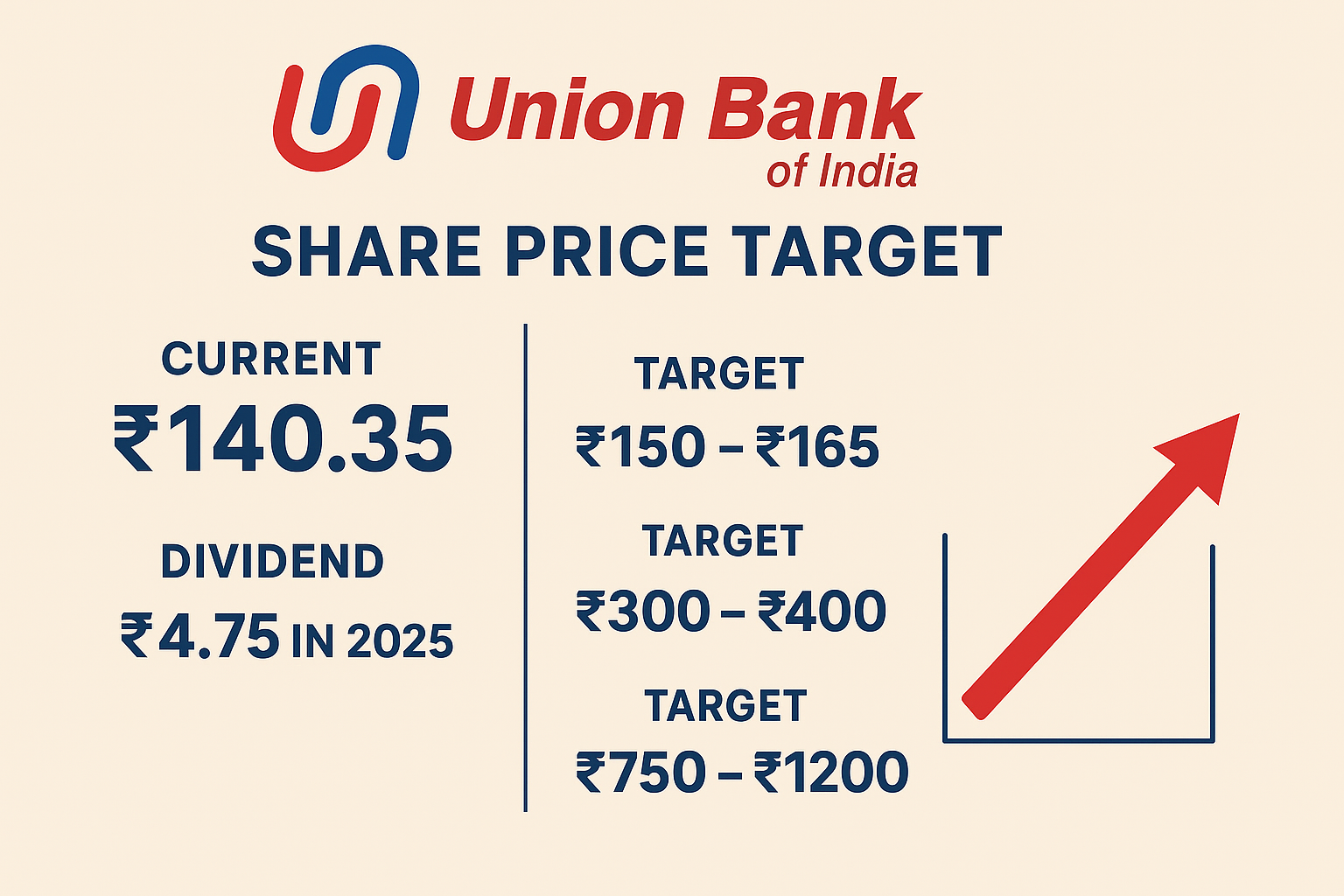

- Dividend History: In 2025, Union Bank declared ₹4.75 per share as dividend.

📈 Union Bank of India Share Price History

Union Bank has witnessed significant fluctuations in the past:

- 52-week High (2025): ₹158.65 (03-Jun-2025)

- 52-week Low (2025): ₹100.81 (13-Jan-2025)

- Current Price (19-Sep-2025): ₹140.35

This shows strong recovery from January lows, giving 40%+ returns in less than 9 months.

🔮 Union Bank of India Share Price Target 2025

Based on current fundamentals, financial results, and PSU banking sector growth, experts predict:

- Short Term (Dec 2025): ₹150 – ₹165

- Medium Term (2026): ₹175 – ₹190

Reasons:

- Strong credit growth in retail and MSME sector

- Declining NPAs

- Government’s focus on PSU banks recapitalization

- Rising digital adoption among customers

📌 If market sentiment stays positive, Union Bank may cross ₹165 by end of 2025.

🏦 Union Bank of India Share Price Target 2030

Looking at the long-term growth story:

- India’s GDP growth projected to stay above 6% CAGR

- Digital banking adoption to drive higher CASA (low-cost deposits)

- PSU bank consolidation to strengthen balance sheets

- Credit demand rising in infra, housing, and SME sectors

Experts predict Union Bank stock can reach:

- Bullish Scenario (2030): ₹350 – ₹400

- Bearish Scenario (2030): ₹250 – ₹280

- Average Target: ₹300

👉 A long-term investor holding for 5–7 years may expect 2x returns from current levels.

🌏 Union Bank of India Share Price Target 2040

Forecasting 15 years ahead is speculative, but considering India’s population, economy, and banking penetration:

- Base Case: ₹750 – ₹900

- Bull Case: ₹1,200+

If Union Bank continues growth, reduces NPAs, and adopts fintech innovations, it may reward investors massively.

⚖️ Risks for Union Bank Investors

Before investing, consider these risks:

- High NPA Risk (though improving)

- Competition from private banks like HDFC, ICICI, and fintechs like Paytm, PhonePe

- Government Dependency: As a PSU bank, policy changes directly impact performance

- Global Economic Slowdowns may hurt credit growth

📌 Should You Invest in Union Bank of India Now?

Union Bank is currently trading at a P/E of just 5.8, making it undervalued compared to private peers. For long-term investors with patience, UBI looks like a strong bet.

- For Traders: Look for breakout above ₹150 for short-term gains.

- For Investors: Accumulate on dips around ₹130–₹135.

🔗 External & Internal Links

- External: Union Bank NSE Quote | Moneycontrol – UBI Share Price

- Internal: Ambuja Cements Share Price Target | Tanla Platforms Share Price Target

❓ FAQs on Union Bank of India Share Price Target

Q1. What is the Union Bank of India share price target for 2025?

A1. Analysts expect UBI to reach ₹150–₹165 by 2025, depending on market sentiment.

Q2. What is the Union Bank of India share price target for 2030?

A2. By 2030, the share price may trade between ₹300–₹400 in bullish conditions.

Q3. Is Union Bank a good stock for long-term investment?

A3. Yes, due to low valuation, government backing, and steady profit growth, it is considered good for long-term.

Q4. What is the risk in Union Bank shares?

A4. Major risks include NPAs, competition from private banks, and global market volatility.

🏁 Conclusion

Union Bank of India is showing signs of steady turnaround and profitability. With strong government support, improving NPAs, and focus on digital banking, it holds potential to be a wealth creator in the coming decade.

👉 For investors seeking long-term growth in PSU banking, Union Bank can be a good addition to the portfolio.

📢 Call to Action

If you found this analysis useful, share it with your friends who are planning to invest in PSU banks. Also, explore more stock price target guides on StockAdda.in. 🚀