SIP & Lumpsum Calculator – The Desi Investor’s Guide

Bhai, sach bolun, paisa kamana tough hai… par paisa bachana aur badaana usse bhi tough hai. Aaj kal ke zamane mein sirf bank FD pe bharosa karke wealth create karna almost impossible hai. Isi liye aaj hum baat karenge ek aise tool ke baare mein jo har Indian investor ka dost ban sakta hai — SIP & Lumpsum Calculator.

Chahe aap SBI SIP calculator use karein, HDFC SIP calculator, ya ICICI bank SIP calculator — concept ek hi hai: aapko pehle se pata chal jaata hai ki aapke investments kitne grow honge.

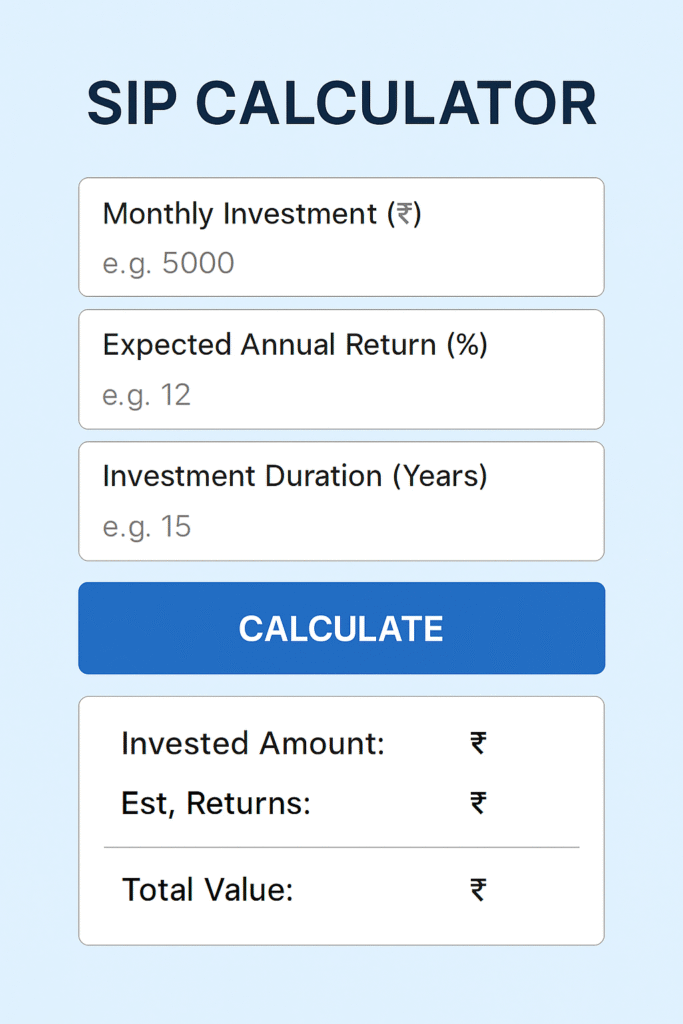

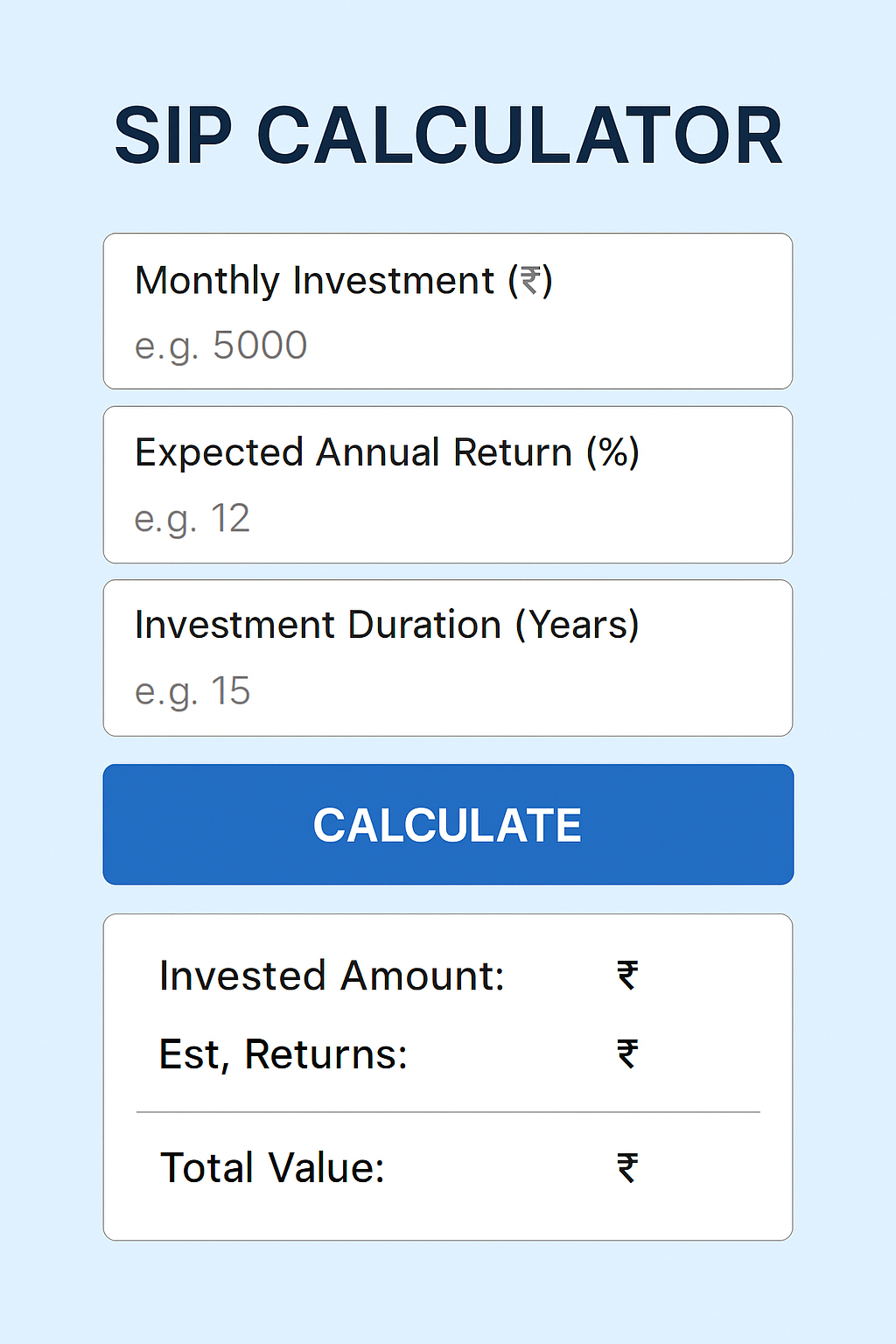

What is an SIP Calculator?

SIP ka matlab hai Systematic Investment Plan — yeh ek aisa tareeka hai jisme aap har mahine thoda-thoda invest karke apne goals achieve karte ho.

An SIP calculator ek online tool hota hai jo aapko batata hai ki agar aap har mahine ek fixed amount invest karein to aapko future mein kitna paisa milega, based on estimated returns.

Example:

Monthly SIP: ₹5,000

Time Period: 10 years

Expected Return: 12% per year

Final Value: ₹11 lakh+

What is a Lumpsum Calculator?

What is SIP

Agar aapke paas ek saath paisa hai (bonus, PF withdrawal, ya property sale se), to aap Lumpsum investment kar sakte ho.

Lumpsum calculator aapko batata hai ki ek baar invest karne ke baad, kuch saalon mein aapke paisa ka size kitna hoga.

Example:

Lumpsum: ₹1,00,000

Time Period: 5 years

Expected Return: 10%

Final Value: ₹1,61,000

Types of SIP Calculators Available

1. SBI SIP Calculator

SBI Mutual Fund ka calculator simple aur beginner-friendly hai. Aap bas amount, duration, aur expected return daalo — result mil jaayega.

2. HDFC SIP Calculator

HDFC SIP calculator me aap Step-Up SIP ka option bhi use kar sakte ho — jisme aap har saal apna investment amount badha sakte ho.

3. ICICI Bank SIP Calculator

ICICI ka calculator kaafi detailed hai. Isme aap SIP with inflation aur yearly SIP growth calculate kar sakte ho.

All in one stock, mutual fund, SIP/Lumsum calculator

Click hare

Special Features Some Calculators Offer

Step-Up SIP Calculator:

Har saal apna SIP amount thoda badha ke aap faster wealth create kar sakte ho.

SIP Calculator with Inflation:

Yeh aapko real future value batata hai, inflation adjust karke.

Yearly SIP Calculator:

Monthly ke bajaye agar aap yearly invest karte ho, to yeh tool use hota hai.

H2 Why Every Investor Should Use These Calculators

Bhai, investment blindly mat karo. Jab aap calculator use karte ho, to:

Aapko realistic goals set karne me help milti hai

Risk kam ho jaata hai

Motivation milta hai investment continue karne ka

Aap dekh sakte ho ki step-up ya lumpsum se kitna farak padta hai

Quick Table – SIP vs Lumpsum

Feature SIP Lumpsum

Investment Monthly fixed amount One-time amount

Risk Spread High (spread over time) Low (market timing risk)

Suitable For Salaried investors Investors with big capital

Example Tools SBI SIP calculator, HDFC SIP calculator Lumpsum mutual fund calculator

Conclusion – Paisa Plan Karke Lagao

Bhai, chahe aap SIP karein ya lumpsum — calculator use karna zaroori hai. Yeh aapko ek clear picture deta hai ki aapka paisa kitna grow karega aur kab aap apne financial goals achieve kar sakte ho.

Yeh baat sabko samajhni chahiye: investment bina plan ke sirf hope hota hai… par calculator ke saath yeh ek solid strategy ban jaata hai.

CTA – Aapka Next Step

Aap bhi abhi apna investment calculate karo. Hamara free Mutual Fund SIP & Lumpsum Calculator use karo aur dekho ki aapka paisa future mein kitna banta hai.

👉 Apna result comment me share karo, taaki dusre readers ko bhi motivation mile.

3 thoughts on “Mutual fund stock SIP & Lumpsum Calculator – Easy Guide for Indian Investors”