SAIL Share Price Target — Bharat ka Steel Bahubali!

Bhaiya, suno ek kahani!

1950 ke decade me jab India apne industrial base banane me busy tha, tab ek aisi company bani jiska naam tha Steel Authority of India Limited (SAIL) — desh ki backbone ban gayi!

Aaj jab hum “Make in India”, “Bharat Manufacturing Hub” ki baat karte hain, to SAIL wahi purani warrior hai jo ab naye armor me ready hai — global steel competition ke liye! 💪

Ab sawaal yeh uthta hai —

👉 “Kya SAIL ka share abhi undervalued hai?”

👉 “Kya SAIL me invest karna long-term ke liye faidemand hai?”

👉 “SAIL share price target 2025, 2030, 2040 kya ho sakta hai?”

Main batata hoon step-by-step — ekdum Bindra style me! ⚡

SAIL Ka Business Model — Steel Se Solid Profits Tak!

Aapko pehle samajhna hoga, bhaiya, SAIL karta kya hai!

SAIL ek Maharatna PSU hai — matlab Government of India ke control me ek steel manufacturing giant.

Ye apne plants se iron ore se leke finished steel products tak sab kuch khud banata hai.

🔹 Major Plants:

- Bhilai Steel Plant (Chhattisgarh)

- Rourkela Steel Plant (Odisha)

- Durgapur Steel Plant (West Bengal)

- Bokaro Steel Plant (Jharkhand)

- Salem Steel Plant (Tamil Nadu)

🔹 Product Portfolio:

- Hot Rolled Coils

- Cold Rolled Sheets

- TMT Bars

- Railway Tracks

- Alloy Steels

- Stainless Steel Products

In short — “Raw iron se ready product tak ek hi roof ke andar.”

🧮 Market Size:

India ka steel industry size 2024 me ₹14 lakh crore ke aaspaas tha.

Government ka target hai 2030 tak isko 300 million tonnes capacity tak badhana.

SAIL currently produces ~20 million tonnes steel yearly — matlab 6-7% national share.

Takeaway:

👉 “Jahan Bharat ka infrastructure badhega, wahan SAIL ki demand bhi badegi.”

Hook line: “Steel banega to Deal banegi — SAIL ke saath!”

Fundamental Analysis of SAIL — Numbers Don’t Lie!

Let’s open the financial dashboard, bhaiya.

| Metric | FY2025 | FY2024 | FY2023 |

|---|---|---|---|

| Total Income | ₹29,61,654 lakh | ₹24,19,793 lakh | ₹23,473,100 lakh |

| Net Profit | ₹1,17,796 lakh | ₹1,068 lakh | ₹2,97,700 lakh |

| EPS | ₹2.85 | ₹0.03 | ₹7.30 |

| P/E Ratio | ~21.5 | – | – |

| Market Cap | ₹55,803 crore | – | – |

🔹 What does this mean?

- FY2025 me profit 100x jump hua compared to last year’s weak quarter — steel price recovery ka asar!

- EPS improve ho raha hai, matlab company apna earning power wapas gain kar rahi hai.

- P/E ratio 21 ke aaspaas — PSU steel sector ke hisab se balanced.

Takeaway:

👉 “SAIL ek cyclical stock hai — jab steel sector uthega, SAIL upar udta hai!”

Hook line: “Cycle samjho, timing pakdo, paisa double karo!”

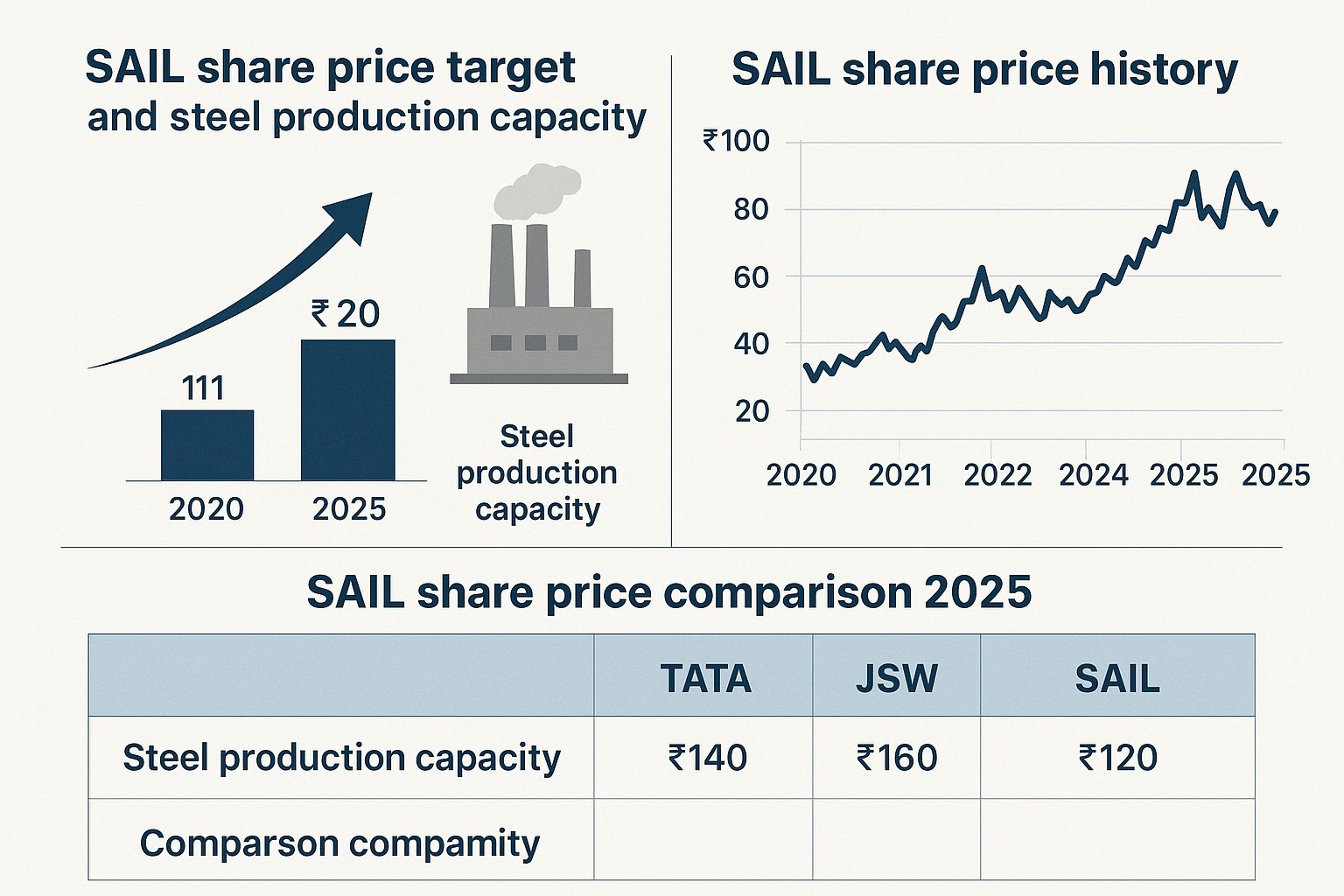

SAIL Share Price History — Past Se Seekho!

| Year | Price (₹) | Remark |

|---|---|---|

| 2020 | 25 | Covid crash – undervalued |

| 2021 | 142 | Boom phase – steel supercycle |

| 2022 | 75 | Correction phase |

| 2023 | 110 | Recovery |

| 2025 | 135 | Stable momentum |

Aap samjhiye bhaiya, SAIL me price movement pure steel cycle pe depend karta hai.

Jab China ya global steel demand badhti hai → prices shoot up → SAIL ka stock chadh jaata hai!

Takeaway:

👉 “Market ka patience hi investor ka profit hai.”

Hook line: “Patience pays more than panic!”

SAIL Share Price Target 2025, 2026, 2030, 2040

Yahan se maza aayega bhaiya! Let’s calculate realistic targets.

🔹 SAIL Share Price Target 2025:

Based on EPS growth and FY2025 quarter results,

expected range = ₹150–₹165

- Steel demand improving due to infra projects

- Government spending boom before elections

- Dividend yield 2%+

Short-term Target (2025): ₹165

🔹 SAIL Share Price Target 2026:

- Steel exports likely to rise (China slowdown = India ka fayda)

- Expected EPS ₹3.5–₹4

Target Range 2026: ₹180–₹200

🔹 SAIL Share Price Target 2030:

- India steel demand 2x hone ka chance

- EV industry + construction boom

- Profit margins stable 10–12%

Target Range 2030: ₹350–₹400

🔹 SAIL Share Price Target 2040:

- Long-term compounding + dividends reinvested

- PSU transformation + private partnerships

Target Range 2040: ₹750–₹900

Takeaway:

👉 “Long-term me PSU bhi multibagger ban sakta hai, bas patience rakho!”

Hook line: “Market me sabse bada risk hai — patience na rakhna!”

Technical Analysis — Chart Pe Nazar Bhaiya!

SAIL ka 52-week high ₹142, low ₹99.

Current price ₹135 ke aaspaas (as on 3 Oct 2025).

🔹 Indicators:

- RSI: 58 → Neutral to bullish

- MACD: Positive crossover

- Support: ₹128

- Resistance: ₹142

Verdict:

If breaks ₹142 → next target ₹160 short term!

If drops below ₹125 → short-term weakness.

Takeaway:

👉 “Chart dekho, par heart se invest karo.”

Hook line: “Technical signal deta hai, conviction paisa banata hai!”

Global Factors — China ka Impact & Steel Prices

Steel ek global commodity hai.

Agar China production kam karta hai → world price badhta hai → SAIL ko fayda!

IMF report ke hisab se, global steel demand 2.3% CAGR se grow karegi next 5 years.

India fastest-growing consumer hai — “China ke baad Bharat ka number hai!”

Takeaway:

👉 “Global market ko ignore mat karo — wahi se trend aata hai.”

Hook line: “Global dekho, local invest karo!”

Dividend Policy — Passive Income Bhaiya!

SAIL PSU hai, aur PSU ka matlab hai regular dividends!

- 2025 me dividend ₹1.6/share

- 2024 me ₹1/share

- Dividend yield ~1.2%

Takeaway:

👉 “SAIL sirf growth nahi deta, income bhi deta hai!”

Hook line: “Dividend aata hai, patience badhta hai!”

Risk Factors — Har Hero Ka Weak Point Hota Hai

- Steel prices volatile (China impact)

- High debt (~₹30,000 crore)

- Government interference kabhi kabhi profitability pe effect karta hai

- Cyclical nature – steel demand pe dependent

Takeaway:

👉 “Stock nahi, business samjho — tabhi risk manage hoga.”

Hook line: “Risk ko samjho, tabhi reward milega!”

Competitor Comparison

| Company | Market Cap (₹ Cr.) | P/E | Profit (₹ Cr.) |

|---|---|---|---|

| SAIL | 55,803 | 21.5 | 11,779 |

| Tata Steel | 170,000 | 12.8 | 31,000 |

| JSW Steel | 175,000 | 17.9 | 30,200 |

Takeaway:

👉 “PSU valuation hamesha discount pe milta hai, par risk bhi kam hota hai.”

Hook line: “Discount me quality mile to deal pakad lo!”

Future Projects — SAIL’s Expansion Drive

- 10 MTPA Bhilai expansion

- Green steel (eco-friendly production) initiatives

- Railways, defense, construction contracts

- Exports to South-East Asia rising

Takeaway:

👉 “Infrastructure ka har brick me SAIL ka contribution hai.”

Hook line: “India banega steel se, aur steel banega SAIL se!”

Investment Strategy — Long Term or Short Term?

- Short Term (6–12 months): ₹165–₹180 target

- Medium Term (2–3 years): ₹250+

- Long Term (2030+): ₹400+

Tip:

Invest via SIP style in stocks – average out volatility.

Takeaway:

👉 “One-time investment nahi, consistent SIP hi wealth banata hai.”

Hook line: “SIP in stocks = Success in patience!”

Expert Opinions

- Motilal Oswal: Positive on long-term PSU metal stocks

- ICICI Direct: Target ₹165 (Buy)

- Moneycontrol Analysts: Accumulate near ₹125

Read SAIL latest reports on NSE India

Takeaway:

👉 “Analyst sirf guide karte hain, investor khud decide karta hai!”

Hook line: “Research karo, conviction rakho!”

Final Verdict

Bhaiya, simple baat —

SAIL ek strong PSU steel player hai, debt control me hai, dividend regular hai, aur growth potential solid hai.

Short term me volatility hai, par long term me yeh desh ke infrastructure ke saath grow karega!

Final Targets Recap:

- 2025: ₹165

- 2026: ₹200

- 2030: ₹400

- 2040: ₹900

Final Hook Line:

🔥 “Steel strong hai, aur SAIL ke investor wrong nahi ho sakte!”

FAQs — SAIL Share Price Target

Q1: What is the SAIL share price target for 2025?

A: According to current fundamentals, SAIL share price target for 2025 is ₹165.

Q2: What is the long-term SAIL share price target for 2030?

A: Based on projected demand and expansion, SAIL share price target for 2030 is ₹350–₹400.

Q3: Is SAIL a good stock for long-term investment?

A: Yes, with government backing, strong assets, and growing demand, it’s a solid long-term pick.

Q4: What is SAIL’s 52-week high and low?

A: High ₹142.12, Low ₹99.15 (as of October 2025).

Q5: Does SAIL give dividends?

A: Yes, regular dividends of ₹1–₹1.6 per share yearly.