💥 SIP vs Modified SIP vs Lumpsum – Kaunsa Investment Aapko Crorepati Banayega? 2025 Guide

“Investment ka Maha-Yudh”

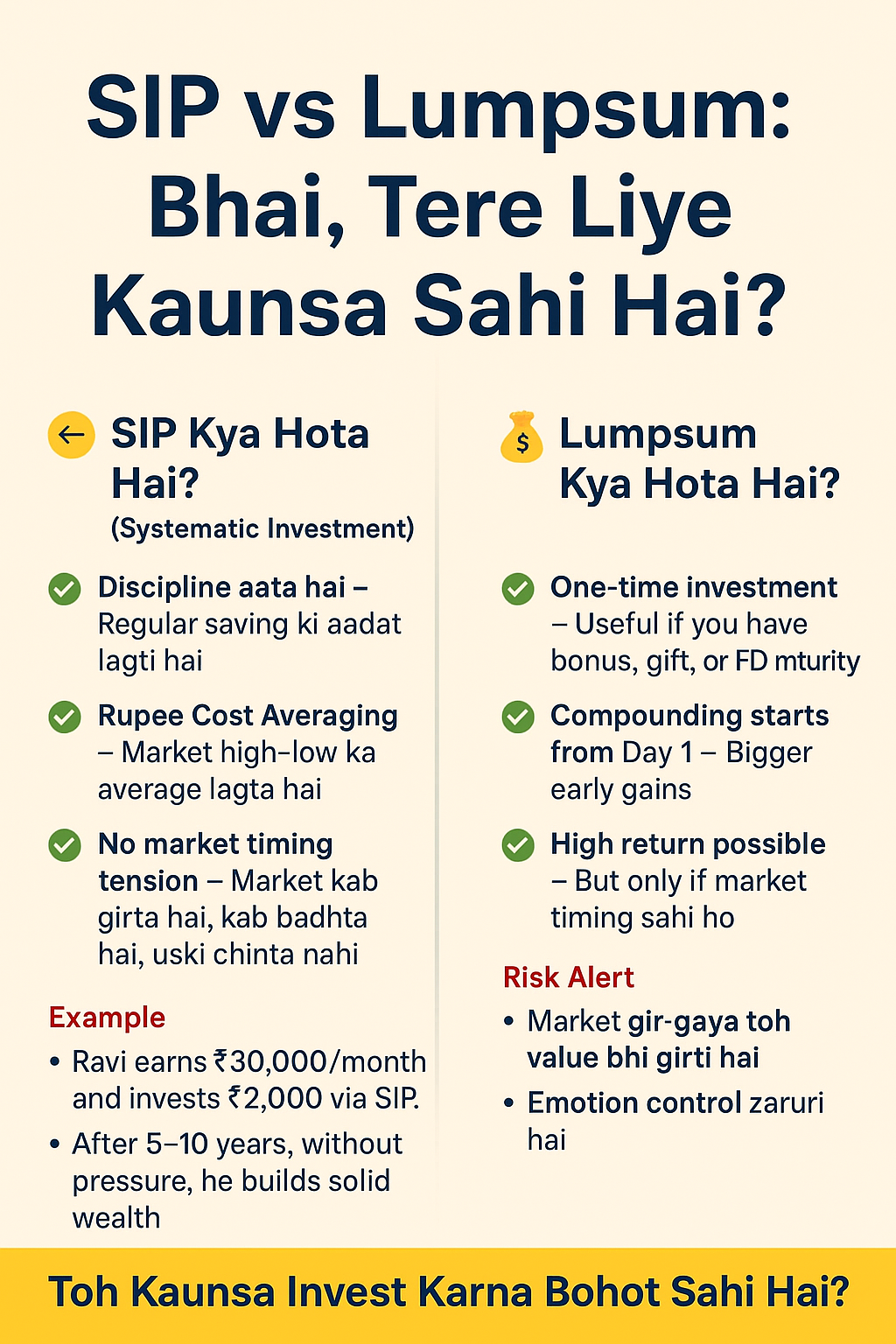

Bhaiya, ek sawal…

Aap 20 saal me ₹10 lakh banate ho ya ₹1.5 crore?

Farq sirf strategy ka hai.

Aaj hum ek aisi real-life inspired story discuss karenge jisme 3 dost – Sunil (Normal SIP), Aman (Modified SIP), aur Meera (Lumpsum) – apna paisa market me invest karte hain.

20 saal baad… teenon ki kismat bilkul alag hoti hai.

📜 1. Teen Dost, Teen Raaste, Teen Kismat

👨💼 Sunil – Normal SIP Hero

2005 me ₹5,000 per month SIP start ki

Market upar ho ya neeche, har month same amount

20 saal me ₹12 lakh invest

Result: ₹12 lakh → ₹50 lakh (Achha hai, par exceptional nahi)

📈 Aman – Modified SIP Genius

2005 me ₹5,000 per month SIP start

Jab market crash hota, amount double/triple kar deta

Extra units liye jab “sale” lagi hui thi

Result: ₹9 lakh invest → ₹1.5 crore (Dip buying + Compounding ka magic)

👩💼 Meera – Lumpsum Princess

2005 me ₹1 lakh ek saath invest

2008 crash me ghabra ke nikal gayi

Loss lock ho gaya, compounding ka chain toot gaya

Result: ₹1 lakh → ₹70,000 (Regret & Fear)

📊 2. 20 Saal ka Sach – Numbers Jhoot Nahi Bolte

| Investor | Investment Type | Total Invested | Final Value | Key Learning |

| Sunil | Normal SIP | 12,00,000 | 50,00,000 | Discipline works, but slow growth |

| Aman | Modified SIP | 9,00,000 | 1,50,00,000 | Market dips are gold mines |

| Meera | Lumpsum | 1,00,000 | 70,000 | Panic is the biggest enemy |

💡 3. Modified SIP – Game Changer Kyu Hai?

Crash = Sale Time → More units, higher future gains

Patience + Courage → Jab sab bech rahe ho, tab kharidna

Step-Up + Modified Combo → Returns ka double engine

Example:

2008 ke crash me Aman ne ₹5,000 → ₹15,000 kar diya 6 mahine ke liye.

Market recover hote hi value multiple ho gayi.

⚠️ 4. Top 5 Mistakes Jo Aapko Crorepati Ban’ne Nahi Deti

1. SIP Miss Karna – Early SIP months sabse powerful hote hain

2. Regular Plan lena Direct ke jagah – Commission se long-term loss hota hai

3. Early Redemption – Compounding ka magic tod dete ho

4. Market Dip ka fayda na uthana – Jab sale ho, zyada invest karo

5. Step-Up SIP ignore karna – Salary badhne pe SIP badhni chahiye

🎯 5. Best Action Plan – “70-30 Rule”

70% Normal/Step-Up SIP for discipline

30% Modified SIP style lumpsum during market dips

Patience rakho – short-term volatility ko ignore karo

🔥 Conclusion – Paisa Sota Hai Ya Kaam Karta Hai?

“Investment ek train hai – jo shuru me chadh jaata hai, uska safar sabse comfortable hota hai. Der mat karo – abhi chadh jao!”

Aman ne paisa apne liye kaam karwaya, Sunil ne paisa bachaaya, aur Meera ne paisa sula diya.

Aap kis category me aana chahoge?

1 thought on “SIP vs Modified SIP vs Lumpsum comparison– Best Investment Strategy for 2025”