Tanla platforms-ltd share price target — A Complete 2025 Guide

Introduction

The Tanla platforms ltd share price target has become one of the most discussed topics among Indian investors and traders. Tanla Platforms Limited, a mid-cap software and communication technology company, often surprises the market with its volatility, corporate actions, and strong dividend policy.

In this detailed guide, we will analyze Tanla’s fundamentals, financial results, intraday technicals, support and resistance zones, and realistic price targets. We will also present 7 practical price levels that traders and long-term investors can use as benchmarks.

Whether you are a beginner in the stock market or a professional trader, this post is designed in simple Indian English, and highly readable.

Table of Contents

- Quick Snapshot of Tanla Platforms Ltd

- About Tanla Platforms Limited (Corporate Summary)

- Key Market Data and Financials (Latest Updates)

- Technical Analysis of Intraday & Historical Data

- Pre-open vs Actual Price Behavior

- Volatility, Returns, and Risk Factors

- Support & Resistance Zones Explained

- 7 Practical tanla-platforms-ltd-share-price-target Levels

- How Traders Can Use These Price Levels

- How Long-term Investors Should Approach Tanla

- Fundamental Checklist Before Setting Targets

- Risk Management & Position Sizing

- A Sample Trade Plan (Step-by-Step)

- FAQs on tanla-platforms-ltd-share-price-target

- Conclusion & Call-to-Action

1. Quick Snapshot of Tanla Platforms Ltd

- Ticker Symbol: TANLA

- Exchange: NSE / BSE

- Industry: Software Products (CPaaS – Communications Platform as a Service)

- Market Cap (Aug 2025): ₹8,214.98 Cr

- Free Float Market Cap: ₹4,376.36 Cr

- 52-Week High: ₹990

- 52-Week Low: ₹409.35

- Adjusted P/E: 17.15

- Promoter Holding: ~45%

- Public Holding: ~54%

2. About Tanla Platforms Limited

Tanla Platforms Limited is an Indian cloud communications and enterprise messaging company. It provides platform-based messaging services to banks, telecom operators, and enterprises.

Key Business Segments:

- Enterprise Messaging Solutions – Transactional & Promotional SMS services

- CPaaS Platform – Cloud-based messaging and API solutions

- International Expansion – Providing services to global clients

- New Age Products – Secure messaging & fraud prevention solutions

Tanla has earned investor attention due to its consistent dividends, occasional buybacks, and steady growth in messaging volumes.

3. Key Market Data and Financials (Jun 2025 Quarter)

- Total Income: ₹22,116.89 Lakhs

- Net Profit: ₹5,227.10 Lakhs

- Earnings Per Share (EPS): ₹3.89

- Annualized Volatility: 53.49%

- Applicable Margin Rate: 21.81%

📌 Note for Investors: Tanla is a smallcap-to-midcap stock, and such companies are high-risk, high-reward.

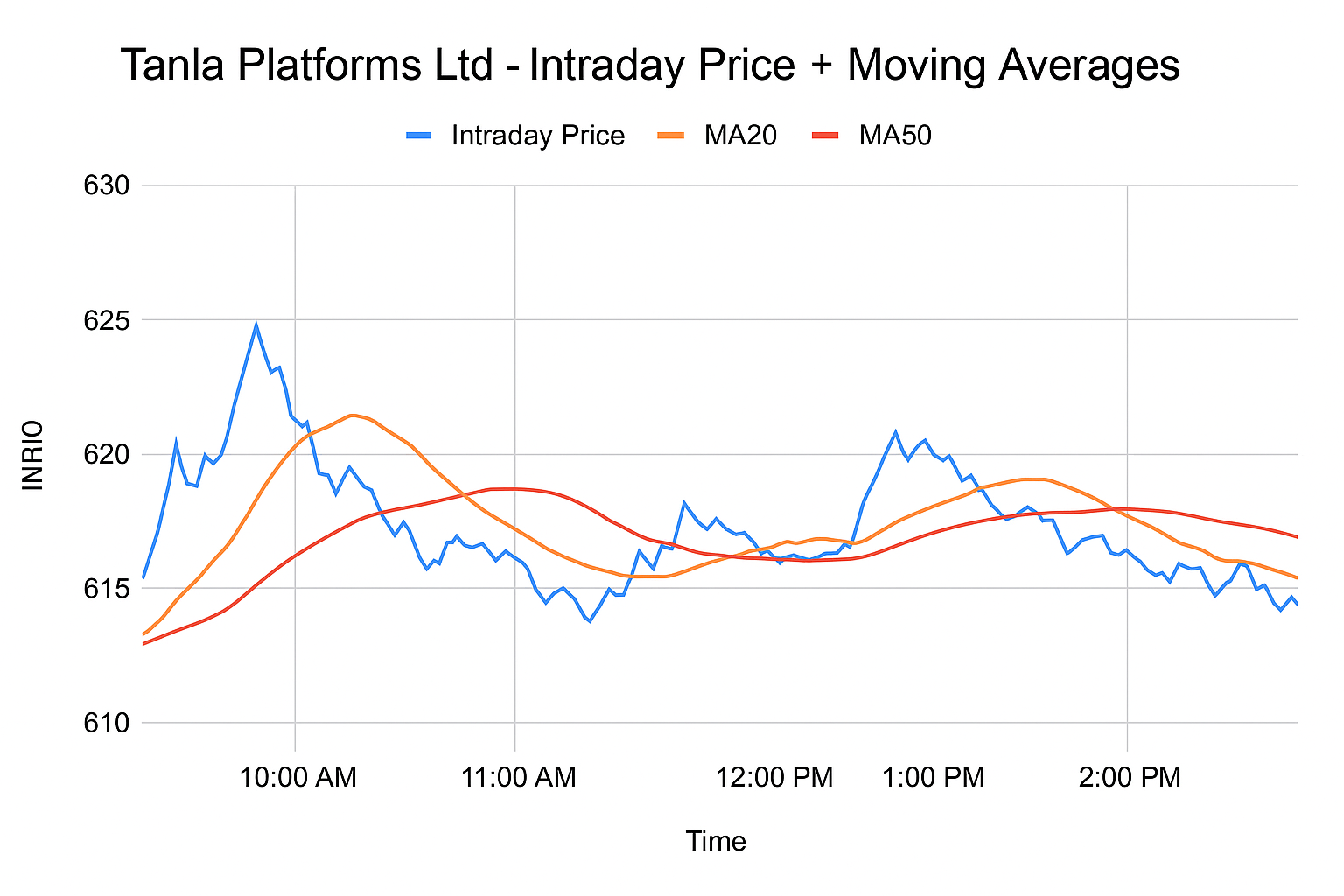

4. Technical Analysis of Intraday Data

Looking at intraday data (Aug 29, 2025):

- Range: ₹617 – ₹629.15

- Mean Price: ₹621.49

- Closing Price: ₹618.10

- Moving Averages:

- MA20 and MA50 indicate support zones and intraday momentum.

✅ When price sustains above MA20 and MA50 → bullish signals.

❌ Break below MA50 on higher volume → bearish signal.

5. Pre-open vs Actual Price Behavior

Pre-open price often sets the tone for the day.

- Pre-open Band: ₹624–626

- If the market opens near pre-open price and moves higher → bullish continuation.

- If price drops below pre-open → possible intraday weakness.

6. Volatility, Returns, and Risk Factors

- Daily Volatility: ~2.8%

- Annualized Volatility: 53.5%

- Risk: Sudden swings due to corporate actions & earnings results

7. Support & Resistance Zones

Support and resistance help traders identify price action levels.

- Support Zone 1: ₹617–620

- Resistance Zone 1: ₹625–627

- Swing Level: ₹635

- Medium-Term Resistance: ₹690–700

- Long-Term Level: ₹800–990

8. 7 Practical tanla-platforms-ltd-share-price-target Levels

Here are 7 price levels for different timeframes:

- Intraday Support: ₹617–620

- First Resistance (Target 1): ₹625–627

- Dynamic Support (MA20): ~₹623

- Swing Target: ₹635

- Medium-Term Target: ₹690–700

- Long-Term Fair Value Band: ₹800–900

- Aspirational Target (52-Week High): ₹990

9. How Traders Can Use These Price Levels

- Intraday Traders: Buy near support (₹620–623), sell at resistance (₹627–635).

- Swing Traders: Target ₹690–700 after breakout above ₹635.

- Long-Term Investors: Accumulate below ₹650 and hold for ₹800–990.

10. How Long-term Investors Should Approach Tanla

Long-term investors must check:

- Revenue Growth (quarterly results)

- Cash Flows

- Promoter Confidence (buybacks/dividends)

- Debt Levels (ideally low for midcap IT companies)

11. Fundamental Checklist Before Setting Targets

✅ Consistent revenue growth

✅ Strong operating margins

✅ Buybacks/dividends as shareholder-friendly actions

✅ Transparent management guidance

❌ High volatility

❌ Risk from competition in CPaaS space

12. Risk Management & Position Sizing

- Never risk more than 2% of capital per trade

- Keep stop-loss below ₹617 for short-term trades

- Use staggered buying for long-term investment

13. A Sample Trade Plan

- Entry: ₹624 (above MA20 with volume confirmation)

- Stop-Loss: ₹618

- Target 1: ₹627

- Target 2: ₹635

- Extended Target: ₹690

Risk/Reward ratio: ~1:3

14. FAQs on tanla-platforms-ltd-share-price-target

Q1. What is the short-term tanla-platforms-ltd-share-price-target?

A: The short-term target is ₹625–627, with swing target at ₹635.

Q2. What is the long-term tanla-platforms-ltd-share-price-target?

A: Long-term investors can aim for ₹800–990, depending on earnings growth.

Q3. Is Tanla Platforms a safe investment?

A: It is a midcap, so volatility is high. Safe only with strict risk management.

Q4. How often should I review tanla-platforms-ltd-share-price-target?

A: At least every quarter (after results) and before major corporate actions.

Q5. Where can I check official Tanla stock data?

A: On NSE, BSE, and Tanla.

15. Conclusion & Call-to-Action

The tanla-platforms-ltd-share-price-target depends on how you balance technicals, fundamentals, and risk management. Traders should focus on short-term levels like ₹625–635, while long-term investors can look towards ₹800–990 if fundamentals stay strong.

📌 Final Tip: Always use stop-loss, diversify your portfolio, and avoid overexposure to one midcap stock.

💬 Your Turn: What’s your personal target for Tanla? Comment below and let’s discuss.