When it comes to investing in consumer-driven companies in India, few names shine as brightly as Varun Beverages Ltd (VBL). Being one of the largest franchisees of PepsiCo globally, the company enjoys a unique monopoly in the soft drink and packaged beverage industry. With its strong distribution network, expanding product portfolio, and consistent revenue growth, investors are naturally curious about the Varun Beverages Ltd share price target for the coming decade.

In this detailed article, we will explore the fundamentals of VBL, past performance, recent financial results, technical trends, and most importantly, projected share price targets for 2025, 2030, and 2035. Whether you are a beginner in the stock market or a seasoned investor, this guide will help you make an informed decision.

📌 About Varun Beverages Ltd

- Incorporation: Listed on NSE and BSE since 2016

- Business: Exclusive bottling and distribution partner of PepsiCo in India and several international markets

- Products: Carbonated soft drinks (Pepsi, Mountain Dew, 7Up), packaged drinking water (Aquafina), energy drinks, fruit-based drinks (Tropicana), and more

- Industry: Beverages & FMCG (Fast-Moving Consumer Goods)

- Market Cap: ₹1,58,783 crore (as of Sep 2025)

- Index Inclusion: Nifty Next 50

The company’s wide presence in both urban and rural areas ensures steady demand. With India’s growing youth population and rising consumption of packaged beverages, VBL is well-positioned for long-term growth.

📊 Key Financial Performance of Varun Beverages

Understanding financials is crucial before predicting the Varun Beverages Ltd share price target. Let us look at the latest quarterly results and historical growth.

🔹 Quarterly Results (in ₹ Lakhs)

| Quarter | Total Income | Net Profit | EPS (₹) |

|---|---|---|---|

| Jun 2025 | 5,39,503.50 | 1,16,016.10 | 3.43 |

| Mar 2025 | 4,11,232.70 | 67,806.00 | 2.01 |

| Dec 2024 | 2,16,792.50 | 20,861.70 | 0.63 |

| Sep 2024 | 3,18,701.60 | 49,233.80 | 1.52 |

| Jun 2024 | 5,86,883.60 | 1,15,013.60 | 8.85 |

👉 Clearly, Varun Beverages has shown consistent profitability with strong revenue growth, particularly during the summer quarter when beverage demand peaks.

🔹 Shareholding Pattern (June 2025)

- Promoter Holding: 59.82%

- Public Holding: 40.18%

- FII/DII Interest: Rising steadily, indicating institutional confidence

A high promoter holding with increasing institutional participation signals strong long-term trust in the company.

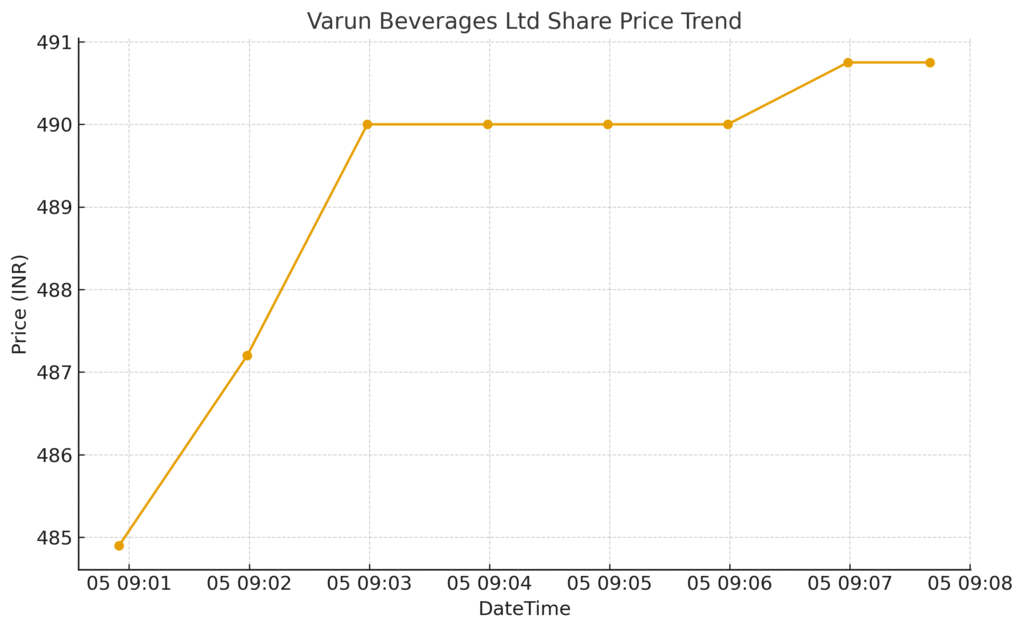

📈 Varun Beverages Share Price History & Technical Analysis

- 52 Week High: ₹668 (Sep 2024)

- 52 Week Low: ₹419.55 (Mar 2025)

- Current Price Range (Sep 2025): ₹520–₹540

- P/E Ratio: 106.31 (high, but justified for growth FMCG stocks)

🔹 Moving Averages & Trends

- The 20-day and 50-day moving averages suggest bullish momentum building after correction from its 52-week high.

- Long-term charts indicate a strong uptrend since listing in 2016, where the stock has given multi-bagger returns.

🔮 Varun Beverages Ltd Share Price Target 2025

By the end of 2025, analysts expect VBL to maintain its growth trajectory driven by:

- Expanding product portfolio (low-sugar & health drinks)

- Seasonal demand in India’s tropical climate

- Strong earnings in Q2 and Q3 every year

- Ongoing international expansion

Projected Target for 2025:

- Minimum Target: ₹600

- Maximum Target: ₹720

- Average Target: ₹660

👉 Investors holding from current levels can expect 15–20% upside in the short term.

🔮 Varun Beverages Ltd Share Price Target 2030

Looking at India’s growing middle class and rising preference for branded beverages, VBL has immense potential. Factors contributing to growth:

- Increasing per capita consumption of soft drinks

- Rural penetration with affordable SKUs (₹10 bottles/cans)

- Consistent dividend payouts (interim dividends every year)

- Strong promoter support and global franchise

Projected Target for 2030:

- Minimum Target: ₹1,250

- Maximum Target: ₹1,500

- Average Target: ₹1,380

👉 This suggests that Varun Beverages could double investors’ wealth in 5 years.

🔮 Varun Beverages Ltd Share Price Target 2035

By 2035, VBL is expected to emerge as a global beverage leader, not just in India. With PepsiCo’s trust and franchise rights, the company may diversify further into packaged foods and energy drinks.

Factors to consider:

- Possible entry into new international markets

- Adoption of healthier drink alternatives

- Increasing urbanization in India

- Strong cash flows enabling acquisitions and expansions

Projected Target for 2035:

- Minimum Target: ₹2,800

- Maximum Target: ₹3,500

- Average Target: ₹3,150

👉 A true wealth compounding stock for long-term investors.

⚖️ Risks & Challenges

Before investing, consider the following risks:

- High dependence on PepsiCo for product portfolio

- Regulatory restrictions on sugary drinks in the future

- Seasonal demand fluctuations

- Valuation concerns (currently trading at high P/E)

However, given India’s rising consumption story, these risks may be balanced by long-term growth.

📌 Pros & Cons of Investing in Varun Beverages

✅ Pros

- Strong PepsiCo franchise rights

- Consistent revenue & profit growth

- Dividend paying company

- High promoter & institutional holding

❌ Cons

- Expensive valuation compared to peers

- Dependency on single brand (PepsiCo)

- Regulatory risks on carbonated drinks

📚 Internal & External References

- NSE India – Varun Beverages

- BSE India – Varun Beverages

- SEBI – Investor Education

- Investopedia – P/E Ratio Explained

- Read our detailed guide on SIP vs Lumpsum Investment

❓ FAQs on Varun Beverages Ltd Share Price Target

Q1. What is the Varun Beverages Ltd share price target for 2025?

The Varun Beverages Ltd share price target for 2025 is between ₹600 and ₹720.

Q2. What is the Varun Beverages Ltd share price target for 2030?

By 2030, the Varun Beverages Ltd share price target is projected between ₹1,250 and ₹1,500.

Q3. Is Varun Beverages a good long-term investment?

Yes, given its strong franchise rights with PepsiCo, consistent growth, and market leadership, VBL is considered a solid long-term bet.

Q4. What is the Varun Beverages Ltd share price target for 2035?

The Varun Beverages Ltd share price target for 2035 is between ₹2,800 and ₹3,500.

Q5. Does Varun Beverages give dividends?

Yes, the company has consistently declared interim dividends, making it attractive for income-seeking investors.

🏆 Conclusion

To sum up, Varun Beverages Ltd share price target from 2025 to 2035 shows strong potential for wealth creation. Backed by PepsiCo’s trust, a robust distribution network, and India’s booming beverage consumption, VBL remains one of the most promising FMCG stocks in the country.

For short-term investors, 2025 targets indicate steady upside. For long-term investors, holding till 2030–2035 can deliver multi-bagger returns.

👉 If you are planning long-term investments in consumer-driven companies, Varun Beverages Ltd deserves a place in your portfolio.

Call-to-Action (CTA):

💡 Want to learn more about stock investing? Explore our detailed guides on Stockadda.in and stay ahead in your wealth creation journey! 🚀