What is SWP? SIP vs SWP

What is SWP? SIP vs SWP – The Complete Guide for Indian Investors

In India, money is not just a medium of exchange — it’s a tool for security, dreams, and dignity. From the young professional saving for a first home to the retired couple ensuring monthly expenses are met, financial planning plays a key role in shaping our future.

Two terms you often hear in the world of mutual funds are SIP (Systematic Investment Plan) and SWP (Systematic Withdrawal Plan). While they sound similar, their purposes are entirely different. If SIP is about building wealth, SWP is about enjoying that wealth.

Let us understand What is SWP and the detailed comparison of SIP vs SWP in the Indian context.

What is SWP (Systematic Withdrawal Plan)?

SWP, or Systematic Withdrawal Plan, allows you to withdraw a fixed amount from your mutual fund investment at regular intervals — monthly, quarterly, or annually.

It is the reverse of an SIP. In an SIP, money flows into the investment, while in an SWP, money flows out.

Example:

Suppose you have ₹12 lakh invested in a mutual fund. You set up an SWP to withdraw ₹25,000 every month. The mutual fund redeems enough units to pay you that amount, while the rest of your investment stays invested and continues to grow (depending on market performance).

Benefits of SWP

1. Regular Income Flow – Ideal for retirees or those seeking passive income.

2. Capital Growth Potential – Remaining investment continues to earn returns.

3. Tax Efficiency – Only the gains portion of withdrawals is taxed, unlike fixed deposit interest.

4. Flexibility – You can choose withdrawal frequency and amount.

What is SIP (Systematic Investment Plan)?

A SIP allows you to invest a fixed amount in a mutual fund at regular intervals — typically monthly. This approach makes investing affordable, disciplined, and stress-free, even for beginners.

Example:

If you invest ₹5,000 every month in an equity mutual fund for 10 years with an average return of 12% per year, your total investment of ₹6 lakh could grow to over ₹11 lakh.

Benefits of SIP

1. Start Small – Begin with as little as ₹500 per month.

2. Rupee Cost Averaging – Reduces the impact of market volatility.

3. Power of Compounding – Your returns generate further returns over time.

4. Goal-Oriented Investing – Perfect for retirement planning, children’s education, or buying a home.

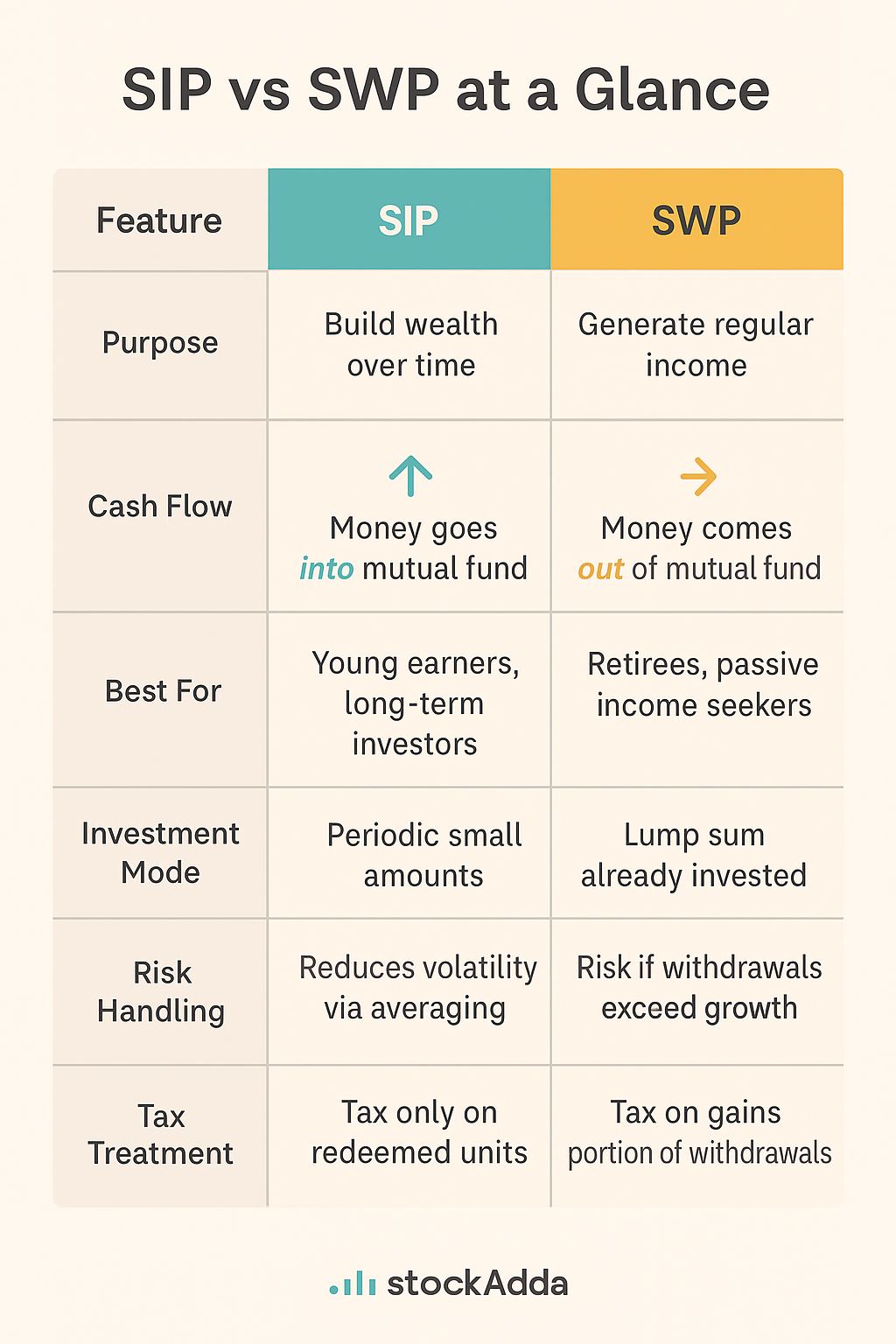

SIP vs SWP – Key Differences

Feature SIP SWP

Purpose Build wealth Generate regular income

Cash Flow Money goes into mutual fund Money comes out of mutual fund

Best For Young earners, long-term investors Retirees, passive income seekers

Investment Mode Periodic small amounts Lump sum already invested

Risk Handling Reduces volatility via averaging Risk if withdrawals exceed growth

Tax Treatment Tax only on redeemed units Tax on gains portion of withdrawals

Which is Better – SIP or SWP?

Choosing between SIP and SWP depends on your stage in life and financial goals:

If you are earning and building wealth, choose SIP.

If you are retired or need regular income, choose SWP.

Many smart investors use both — SIP during working years and SWP after retirement.

Expert Tips for Indian Investors

1. Choose Quality Funds – Whether SIP or SWP, select mutual funds with a solid track record.

2. Don’t Withdraw Too Much – In SWP, withdrawing more than your returns may erode capital.

3. Link to Goals – Align your SIP/SWP with specific life goals.

4. Stay Informed – Follow reliable sources like AMFI – Association of Mutual Funds in India for fund updates.

If you are new to mutual funds, also read –

SIP Meaning in Hindi – Paisa Banane Ka Simple Tareeka.

Conclusion

SIP vs SWP is not about competition — it’s about timing. SIP helps you accumulate wealth, while SWP helps you use that wealth to support your lifestyle. The wise approach is to understand when to switch from one to the other, based on your life stage and needs.

Call to Action

Your money should work for you — not the other way around. Start your SIP today if you’re building wealth, or plan your SWP if you’re ready to enjoy your investments. The sooner you act, the more secure your financial future will be.